Community-based savings groups and vocational and business skills training are two key initiatives under TGF’s Income Generation Programme, which focuses on improving livelihoods by facilitating community-led micro-finance and helping launch micro-businesses.

Many farmers, budding entrepreneurs and other community members in TGF’s target area have benefited from both these initiatives, including Keo Sean*, a 45-year-old widow from Tropeang Veng* village in Siem Reap’s Chikreang district. Unlike most of her neighbours, who are engaged in rice farming, Keo is an itinerant grocery retailer who sells vegetables and other goods from her motorbike. Prior to 2017 she was only able to offer a limited range and quantity of products because she lacked the capital to scale up her business. Her old and rickety motorbike often broke down, forcing her to suspend her sales runs while she waited for her vehicle to be fixed.

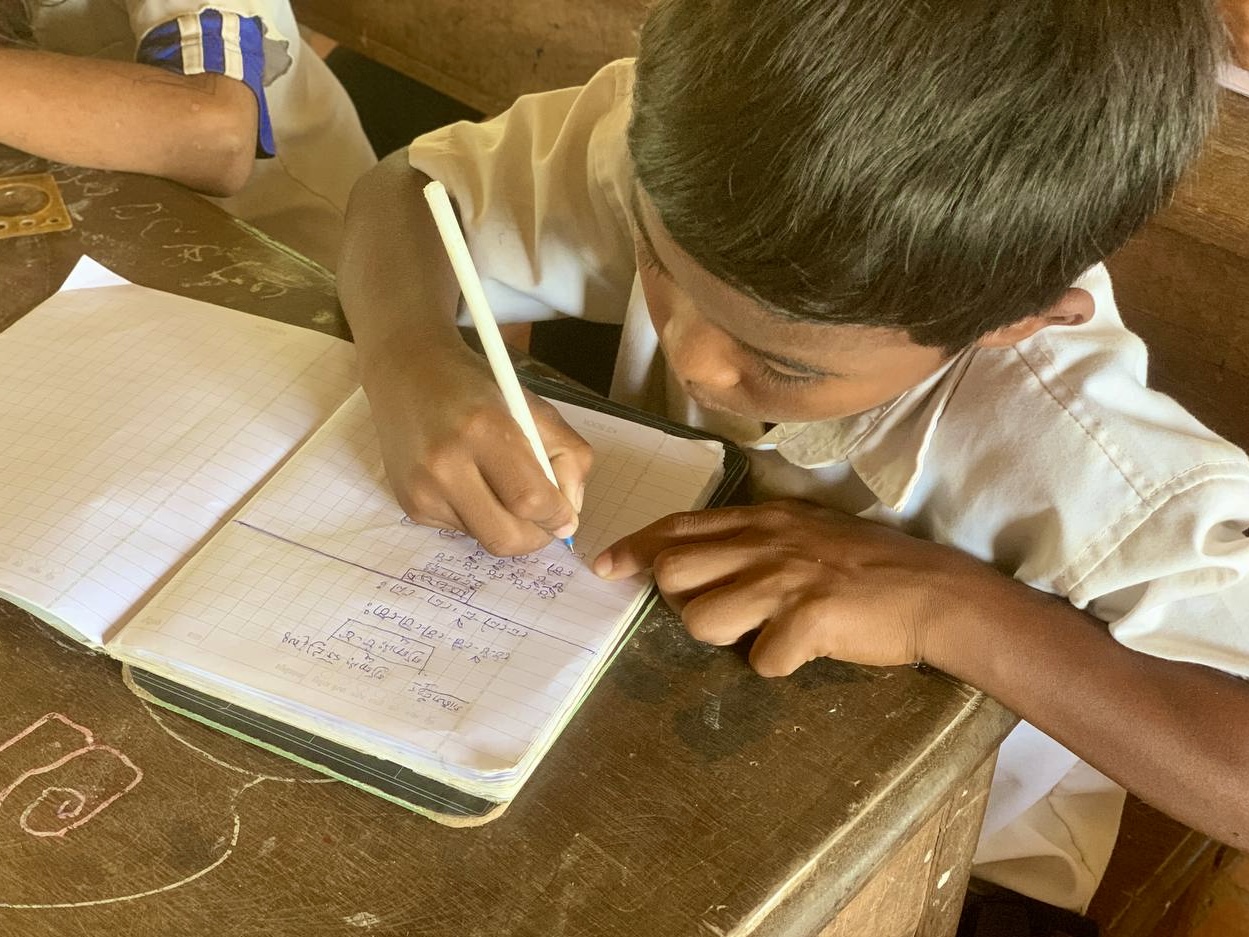

In mid-2017, Keo received a $250 grant from TGF, which allowed her to invest in extensive repairs and expand her product offering. The grant was contingent on participation in TGF’s business training for entrepreneurs, in which TGF staff taught her and 12–15 other participants basic management skills such as bookkeeping, budgeting, selecting profitable products, developing business ideas and writing a business plan. She attended three two-day sessions, some of which included visits to successful local businesses to exchange ideas with more established entrepreneurs.

Armed with new-found business know-how and much-needed confidence, she was able to diversity her product range to include not only vegetables, but also meat, sweets, baked goods and even ready-made meals. She can now afford to purchase 400,000 riel (USD 100) worth of groceries every morning for resale in surrounding villages, and this activity earns her a steady income of 40,000–50,000 riel (USD 10–12) per day. With her increased income, she is also able to participate in her village’s savings group, into which she has deposited around 4 million riel (USD 1,000) thus far.

“Without the help I received from TGF back then,” says Keo, “I wouldn’t be who I am today. I’ve been able to keep both my children in school and to build a proper home for them. Sometimes, when I remember the poor and helpless widow I was, tears come to my eyes. I really want to thank TGF for helping me, and for supporting my whole community. Please continue the great work.”

Noun Tin*, a 40-year-old farmer from Kok Tlouk* village in the same district, tells a similar story. She lives with her husband – a construction worker – and two children: a daughter in secondary school and a son who helps his mother with farming activities.

She joined her village savings group in early 2018. Besides making monthly savings, participation in the group allowed her to take loans from the common fund at an affordable interest rate. She borrowed 4 million riel (USD 1,000) to purchase fertilizer for her rice field and to invest in cassava cultivation. A loan from the savings group, she explains, is easier and faster to obtain than from an MFI.

Noun also participated in TGF’s Integrated Farmer Field School (IFFS), an educational programme that teaches farmers crop and livestock management practices. During 14 weeks of training, she and a dozen other participants learned how to grow a variety of vegetables, raise chicken and fish, create compost, use pesticides safely, and make a production plan. The training sessions were led by TGF staff with the help of extension workers from the Provincial Department of Agriculture, Forestry and Fisheries (PDAFF) for special topics like chicken vaccination and pest control for vegetables. The training included practical tasks like building a chicken coop and preparing raised vegetable beds.

As a result of her training and the loan she received from the savings group, Noun was able to harvest 5.7 tonnes of rice from 2.7 hectares of land – a healthy yield for a smallholder. She sold 2.7 tonnes to pay back the loan and kept 3 tonnes to feed her family and store for later sales. While she hasn’t harvested any cassava yet, she expects to earn around 6 million riel (USD 1,500) from 1.5 hectares of cultivation. Noun also used some of the loan to fund her daughter’s schooling.

“Participating in the TGF savings group taught me a lot,” acknowledges Noun. “I understand the financial side of things better now. Without this financial literacy, I wouldn’t be able to manage my plot or buy more land. In fact, during the Covid-19 pandemic, I probably would have lost the land that I do own.”

*Please note names of people and villages have been changed to protect identity.